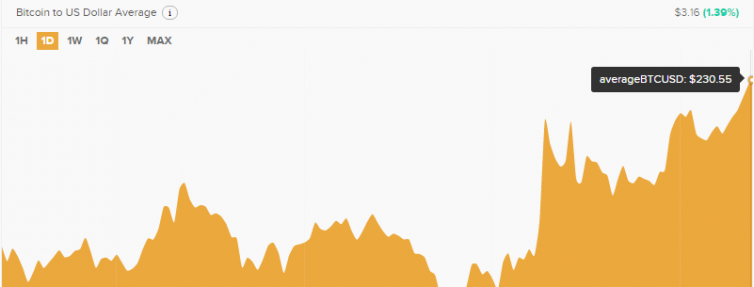

On 24th of August, 2015, the price of Bitcoin decreased below $200 and hit a six-month low. However, several days after the disturbing news, the world’s favourite crypto currency seems to be slowly recovering.

According to data provided by CoinDesk, Bitcoin hitting $198 was the lowest average price in the last six months. The fall of Bitcoin’s worth was seen as a result of the market turbulence and volatility in stock markets all around the world. Also, Bitinex’s outage was just another reason for Bitcoin to witness such a low price this August. The Hong-Kong based exchange closed its order book for a seven-hour period the very same day and saw its price decreasing for additional 3.8% after it reopened.

The latest happenings in the Bitcoin market affected negatively the Internet currency that was falling until reaching its lowest point. Before stumbling below $200, the Bitcoin price noted a steep fall of 14% to a four-month low at $214.04. According to a Bitcoin market maker’s statement for CoinDesk, lot of people didn’t want to be the last ones to be able to sell because of the “brittle markets… coupled with overhang from the block size debate.”

Nevertheless, things got positive in the past few days when the price started to grow. Since then, it noted a new high of $234.01 on 28th of August and it didn’t go close to the infamous $200 borderline.

Current Growth Doesn’t Necessarily Mean the Crisis is Over

Today’s opening Bitcoin price was $228.61 and the 31st of August high reached insignificant $228.81. This means that, despite of the favourable direction in which the Bitcoin price is moving, things can get messy again.

The previous high of the price was $237.66 and the current situation doesn’t provide hopes that it will be soon reached again. It’s believed that if the Bitcoin’s worth goes over $235 things will change in favour of the currency. However, this moment still hasn’t happened.

Additional reason to worry is the moving average of the 30-day SMA of $250.0727 that has crossed the 200-day SMA of $250.7289 on the downside. Such situations, when a long-term moving average is crossed on the downside by a short-term moving average, signal a bearish trend.

Furthermore, the money flow index reached its highest point in more than three weeks of 53.9439. Also, the relative strength index cannot be ignored since it’s revealing a weakness at its 38.0798.

Stay Out and Wait for another Price Wave

Therefore, it can be concluded that the latest trend of Bitcoin price growth doesn’t necessarily mean better times for the crypto currency. Many experts in the field warn market participants that if the current $215-220 fails to be protected, everyone can expect new swift declines to $200 or below. Thus, one of the most common advices found on reputable Bitcoin sites is to stay out and wait for at least one additional price wave before you start trading your Bitcoins again.

If you really must participate in the market, then it’s the smartest to build short positions on growths until $235 is reached on a closing. Finally, in the next couple of sessions market participants should expect low volatility.